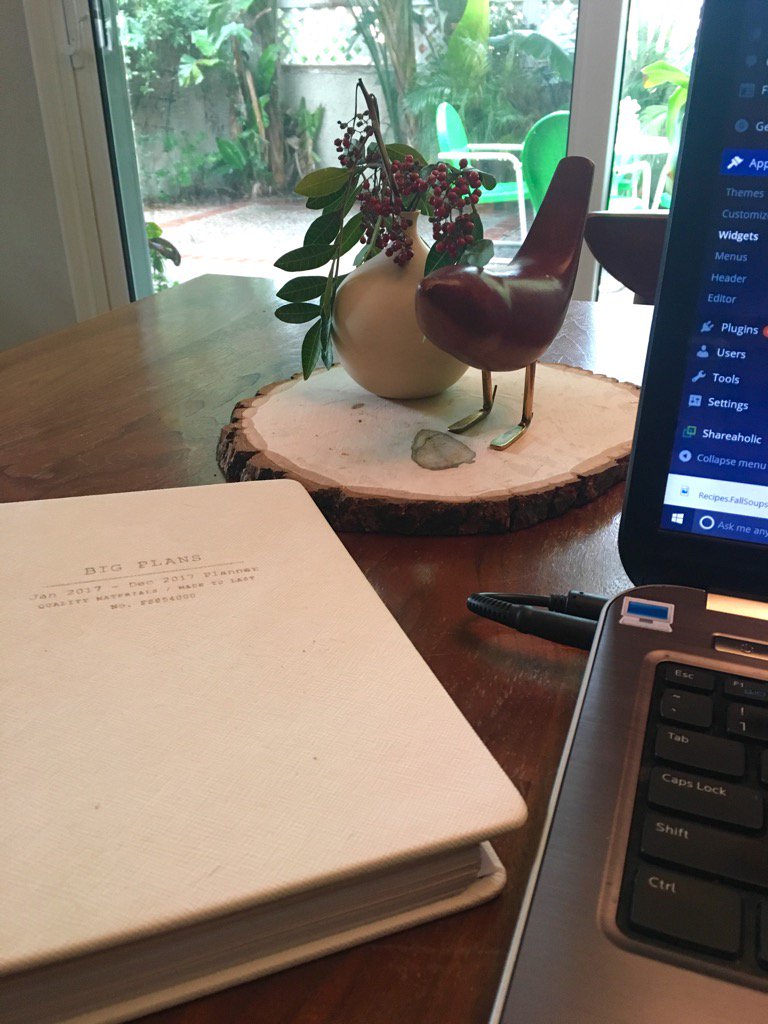

Money: Save by Cutting Corners

Children have a wide range of needs. The problem that parents might face is finding the funds to pay for the needs of the entire family while also putting aside a little extra for emergencies, college and retirement. By following a few money saving tips, parents can reduce the expenses and provide a great lifestyle for the present.

Buy a Used Car

Buying a new car is not the best way to handle personal finances or the financial needs of a family. According to DaveRamsey.com, the average new car costs around $26,000 and the interest rate on that new car averages 9.6 percent. That means a new car will result in monthly payments that are around $500, which can add up quickly.

Instead of browsing through new cars at the dealership, you may want to visit some used-car lots to look for the best deal for your family. According to Edmunds.com, you’ll save money on insurance, get the best deal and you may be able to get a car still under warranty. CarsDirect.com reports that the amount of depreciation right off the lot can be as high as 20 percent and it only gets higher the longer you have your car. Bankrate.com states that each year, a car loses 15 to 20 percent of its value.

Negotiate for Better Deals

Although it is not possible to negotiate for every purchase, it is possible to get deals on larger items by understanding the basics of bartering. According to Thorin Klosowski on LifeHacker.com, everyone can benefit from learning the basics of negotiation. Even small negotiations like getting extra days off at work can add up in extra money by the end of the year.

The only way to negotiate for a better deal on large purchases, special items or extra income is by understanding the actual value. Taking time to ask for deals and look for ways to cut the expense is a frugal parent’s secret to prevent overspending.

Eat at Home

According to LivingOnADime.com, the average family will spend as much as $300 to $500 a month to eat out at restaurants. Cutting back on restaurant dining by eating more meals at home will have a dual impact on the family; eating at home will dramatically reduce the expense of food during the month and your family will be healthier.

Wait for Sales

Look for sales that cut back on the prices. According to MommyWantsVodka.com, waiting for holiday sales or sales that occur when certain items are being discontinued will provide the opportunity to get great deals on more expensive purchases. If you don’t want to go to second-hand clothing stores, buying summer clothes at the winter clearance sale at your child’s favorite store will save your family money as well.

Fun Activities Close to Home

Your kids will have as much fun running around with you in the backyard or park as they will going to the zoo. But if you do want to get out, there are many low-cost or free activities to enjoy in your town.

- Go to your town’s website and check the community calendar

- Go to the library to rent books and movies

- Go to a local pool, when weather permits

- Go to a local playground

- Build a cardboard castle

- Go on a hike, bike ride or a long walk

About the Author:

Stacie Morgan. Stacie is a writer and everyone’s favorite fix-it friend. She enjoys hanging out with Max, her dog, and starting large and daring DIY projects at her home in Michigan.

Photo courtesy of Flickr: https://www.flickr.com/photos/iamtonyang/3313721249/sizes/z/in/photostream/

0