-

Plan :: Some Bookkeeping Tips

Some of My Favorite Bookkeeping Tips · KEEP THINGS SEPARATE o Keep your business and personal records and transactions separate from one another. You should have separate bank accounts and credit cards for your business and personal use. Purchases that are related to your business should be made with a business credit card or with a business checking debit card. This makes it a lot easier for your bookkeeper and tax preparer to easily determine expense categories. · KEEP GOOD RECORDS o Keep and file all of your receipts, invoices, bank and credit card statements and any other documents pertaining to your business. Make sure to use a system that…

-

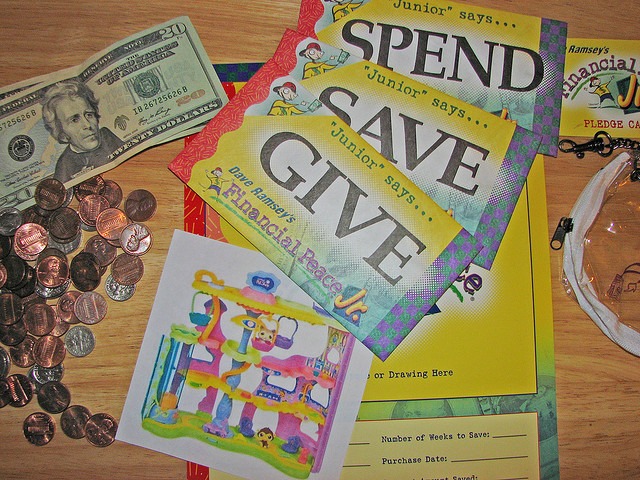

Teaching Your Kids About Money

Teaching Your Kids About Money As a bookkeeper I have seen just about every method of saving and spending there is. Everyone has their own way of doing it. But where did they learn how? My mother always tells the story of when I got my first babysitting job at age 12. I took the money I earned and divided it into thirds. I put one third each into a Holiday Savings Account, my regular bank account and into my pocket for spending that week. The following week I took whatever was left in my pocket, added it to what I made and then did my dividing. I was…

-

Why Should I Reconcile My Bank or Credit Card Statements?

Why Should I Reconcile My Bank or Credit Card Statements? I often come across new clients who say, “I have money in my account at the end of the month; why do I need to reconcile the account?” Well, for starters, if you don’t reconcile the account(s) you will have trouble creating that budget that we talked about. Also, if you are a victim of fraud, you won’t necessarily know unless you at least review the statement. Finally, if you are a business owner, reconciling the statement ensures that you have taken all of your expenses into account so you won’t miss out on any tax deductions.…

-

My Top Budget Trimming Tips (or “Oh No! I’m Overbudget!”)

It happens to all of us. We make that list of expenses and the total amount exceeds our income. What to do! Here are some of my favorite tips: Eliminate the unnecessary. Find those items on the list like gym memberships or other subscription services. Anything that you don’t use regularly or really look forward to receiving should be canceled. Seek out lower cost options for your “Needs”. Try bundling services for discounts. Many cable companies offer discounts for combined cell phone, land line, internet and television. You can also get great discounts on your insurance by getting multiple policies with one company. I have been with…