Why Should I Reconcile My Bank or Credit Card Statements?

Why Should I Reconcile My Bank or Credit Card Statements?

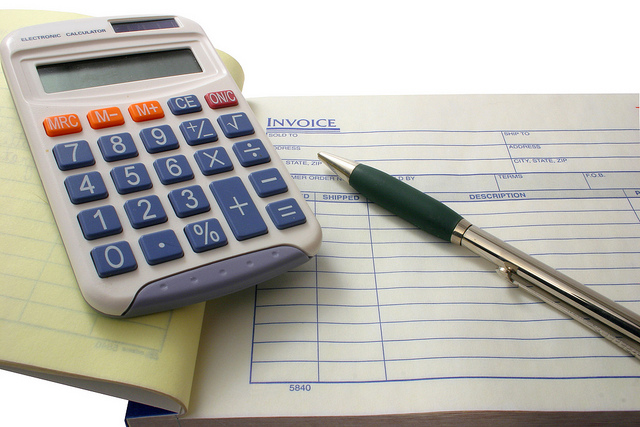

I often come across new clients who say, “I have money in my account at the end of the month; why do I need to reconcile the account?” Well, for starters, if you don’t reconcile the account(s) you will have trouble creating that budget that we talked about. Also, if you are a victim of fraud, you won’t necessarily know unless you at least review the statement. Finally, if you are a business owner, reconciling the statement ensures that you have taken all of your expenses into account so you won’t miss out on any tax deductions.

You Could Miss Something:

We’ve been talking about budgets and ways to cut them. If you are not reviewing the bank or credit card statements that you receive you may miss debits or charges that are processed automatically from your accounts. Maybe you signed up for a subscription service and have forgotten all about it. Many of those companies make a LOT of money from people who either sign up on purpose (or unwittingly) and because they don’t review their statements they never cancel the service they are not using or never even wanted. Don’t be one of those people. There could be money coming out of your account that could be put back into your budget.

Fraud:

Fraud; we all think it can’t happen to us. Wrong. I had my own business debit card compromised twice in 2011. I was very angry! After it happened I attended a seminar on identity theft. I was amazed at how easy it is for my identity to be stolen. The earlier you catch this type of activity, the better you can stop it. I happen to check my online banking fairly regularly, so I saw right away that money had been taken out of the account that shouldn’t have been. But reviewing and reconciling your bank and credit card statements gives you an opportunity to see just what monies come out of your accounts each month and address anything that appears amiss.

Tax Deductions:

Finally, do it for some tax deductions. If you have a home-based business, there are a lot of things you may be able to write off. By reconciling your bank statement, you can ensure that you have accounted for all of your expenses. Then when it comes time to get ready for your tax preparer you will have complete information that will allow them to do their best job for you.

Basically, reviewing and reconciling bank and credit card statements is a way to double check your financial activity for the month. It is an opportunity to keep you budget straight, keep an eye out for fraud and to make the most of your expenses.

Photo courtesy of Flickr: https://www.flickr.com/photos/65819195@N00/5882145769/sizes/z/in/photostream/

Next Time: Business or Hobby?

Brought to you by Wendy Conte

Owner of Wendy Conte, CB ~ “We Do Books So You Can Do Business.”

(661) 993-9313 ~ wendy@bookkeepingscv.com

0